As the number of our sisters in active ministry has dwindled, the Franciscan Sisters of Mary have come to be increasingly reliant on investment earnings to meet expenses. Ten years ago those earnings covered 48% of total expense while today they cover 88%. Therefore, fiscally responsible stewardship of our financial resources is critically important.

Equally important to fulfilling our fiduciary duties is doing so in a manner that does not conflict with our Catholic and Franciscan values. For this reason, the FSM have always complied with our Social Responsibility in Corporate Investment Guidelines to avoid doing harm to people, especially the poor and marginalized, and to the environment. (See our Investment Criteria.)

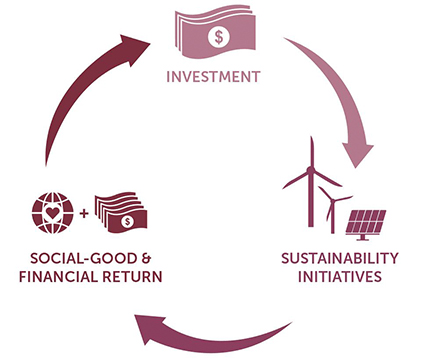

In 2009 our investing doors blew wide open when we discovered “Impact Investing,” a form of investing that generates potentially market-rate returns AND produces measurable social good, i.e., for people and the environment. This prospect was simply too exciting and enticing to pass up.

Process of Impact Investing

Since then the FSM have effectively integrated risk-adjusted, market-rate impact investments into our investment program. That impact portfolio is geared toward reversing the devastating effects of climate change, advancing sustainable land management, and providing clean energy access in places where power generation typically does not exist.

After investing in clean energy and sustainability, removing from our portfolios companies that explore for and extract fossil fuels was a sensible next step. By the end of 2014, we were fully “divested” and had joined the University of Dayton as one of the first U.S. Catholic institutions to divest.

FSM CEO/CFO John O’Shaughnessy was invited to share some of his insights on Impact Investing in a podcast, “Why Faith-based Organizations Are Shifting to Impact Investing,” as part of a podcast series, “From Back Street to Wall Street,” sponsored by Impact Investment Exchange (IIX) and Knowledge@Wharton.